Increasing car taxes: Owners have to pay the extra costs

Published Wed 11th November 2020

When the world is in a crisis, the economy is in crisis. World leaders are wondering how to overcome their country’s economic crisis. Each state leader is trying to survive by adopting one policy at a time. In fact, when all people are in disaster, who will depend on whom! Keeping the price of daily necessities within reach is a big challenge. There seems to be no end to the discussion and criticism to maintain balance. At that moment, the annual tax on the car fell a little extra burden. Car taxes are rising.

When to grow?

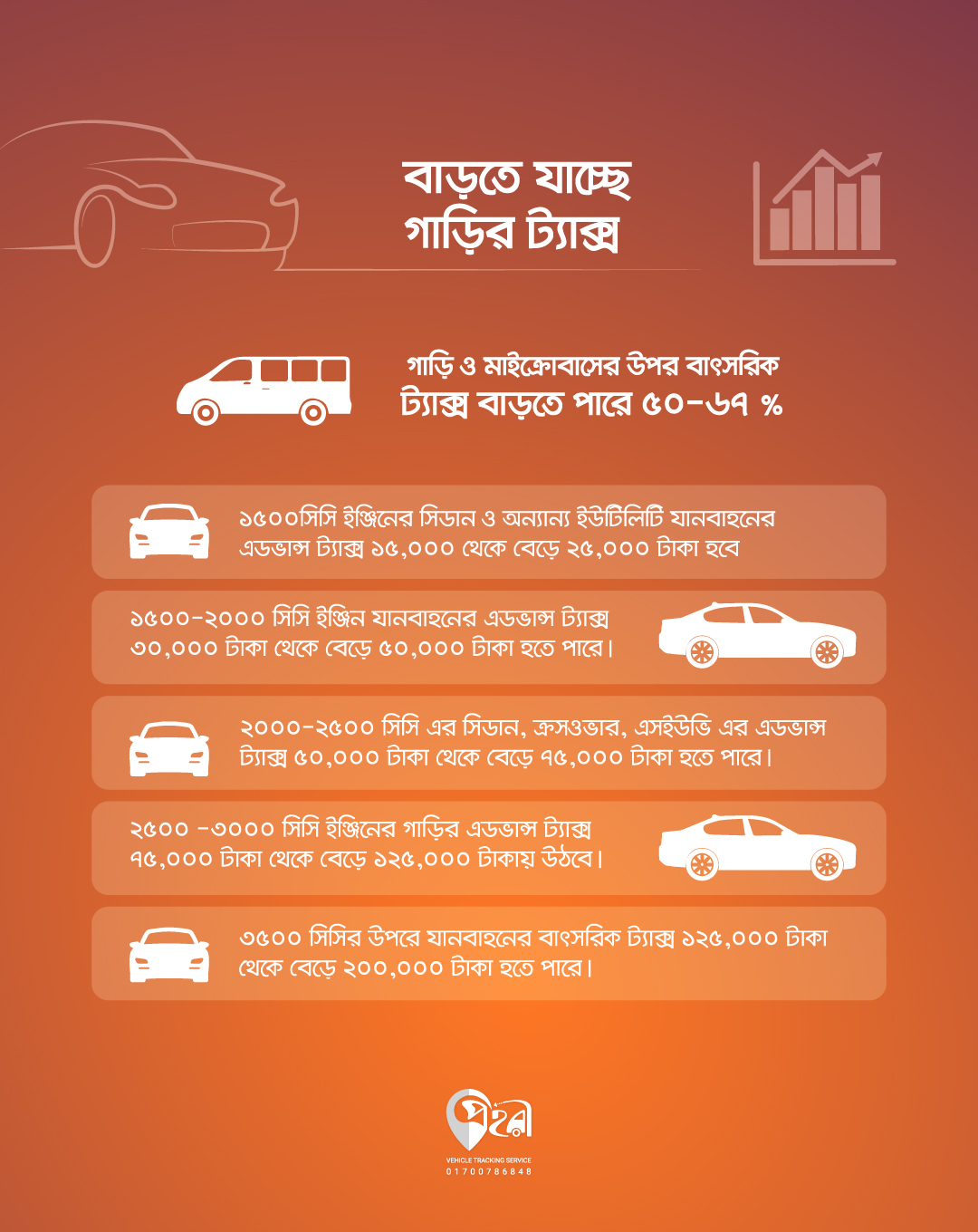

The annual car tax is going to increase by 50-67% in the next financial year! However, part of this tax will depend on the model of the car and the engine capacity. The Bangladesh Road Transport Authority collects advance income tax from car owners under the Tax Act of 1984 when going to register a vehicle or renew fitness! The cost of vehicle registration will be increased in the next financial year. It has been proposed to fix a new advance tax on the engine capacity of the car and the type of car model. If the proposal is accepted, car owners will have to bear the additional cost from July.

How much will the car tax increase?

And this income tax is increasing by up to 50-67%. It is expected to be effective from July 1, 2020.

Earlier the annual income tax on 1500 CC cars was 15,000 but now it has increased to 25,000!

The annual income tax for a 2000CC car was Tk 30,000 and now it is Tk 50,000

You had to pay Tk 50,000 for a car up to 2500 CC, now you have to pay Tk 75,000

Up to 3000 CC, it was Tk 75,000 but now you have to pay Tk 1,25,000.

2 lakh for all vehicles above 3500 CC.

Note that it has increased by 67% to 1500CC, which is mostly used by the middle and lower classes! They now have to pay Tk 25,000 instead of Tk 15,000. This income tax has to be paid every year.

Why is the car tax increasing?

It is part of a plan to increase revenue by increasing the amount of income tax on all types of luxury goods except daily necessities. Those who use luxury products are paying more income tax. Those who want to fulfill their hobbies, according to the law of the country, they have to count the extra money! So the car tax is increasing.

There is a lot of controversy surrounding the sudden increase of 50-67% annual income tax on cars. Paying Tk 25,000 a year for 1500 CC cars used by the middle and lower-middle-class can be difficult in many cases. In addition, luxury car owners will be worried if it becomes effective from July 1.

The anxiety of the middle class

As the Bengali middle class became economically prosperous, cars began to change their way of life. Leaders of the car dealers’ association believe that the annual increase in income tax on cars will dampen the spirits of many when they are looking for a better life despite some financial constraints and are looking for a personal car instead of public transport to protect themselves from the Corona virus. They also say that the price of the car will go up in the future, on top of that the tax interest on the car will be reduced.

The leaders of the organization demanded that the government consider it. According to the BRTA, 5.4 lakh vehicles have been registered till last February.

Although budget expenditures have increased, there is a way to reduce vehicle maintenance and monitoring costs. Prohori Vehicle Tracking Service! Using Prohori will reduce car maintenance costs and time.