If you own a personal car or manage vehicles for a company in Bangladesh, your responsibilities go beyond just driving or maintenance. Keeping your vehicle legally compliant is just as crucial. Unfortunately, many car owners are unaware that failing to renew tax, fitness, or route permits on time can lead to more than just fines—it can result in legal action, vehicle seizure, and even driver arrest. In this blog, we’ll break down:

- The consequences of unpaid vehicle tax

- How to check your tax and fitness status online

- How Prohori GPS Tracker can help you manage legal compliance and cut down on unexpected costs

What Happens If You Don’t Pay Your Vehicle Tax?

Neglecting to pay your car tax doesn’t just result in late fees—it can jeopardize your vehicle’s legal status, insurance claims, and right to operate on public roads. Many people forget or simply don’t know the deadlines, only to face heavy penalties later. Here’s a breakdown of the major risks:

1. Fines & Financial Burden

In Bangladesh, annual motor vehicle tax is based on engine capacity and vehicle type. If you fail to pay it on time, the BRTC and Tax Authority impose interest and penalties. If your tax is overdue by six months or more, the cumulative late fees can become quite substantial. Many vehicle owners only realize it too late, ending up with a large payment that could have been avoided with a timely reminder system.

2. Fitness Expiry & Registration Suspension

Your fitness certificate is proof that your vehicle is roadworthy. If the certificate expires and isn’t renewed along with the tax, your vehicle’s registration may be suspended or even canceled under BRTC rules. This can lead to fines or even seizure at police checkpoints-an issue many drivers face simply because they were unaware.

3. Insurance Claim Rejection

Did you know that if your tax or fitness papers are outdated, insurance companies may deny your claims after an accident? Even if you’ve been paying premiums regularly, missing a tax or fitness renewal can nullify your coverage when you need it most.

4. Legal Troubles & Traffic Cases

Under the Road Transport Act 2018, driving an unregistered vehicle or one with expired tax/fitness is a legal offense. As the owner or driver, you could face court cases, heavy fines, or even arrest—especially during enforcement drives.

Be Smart About Compliance: Awareness First

- Vehicle tax and fitness certificates are usually valid for 1 or 2 years

- Set smart reminders every 11 months to ensure timely renewal

- The BRTA and Traffic Police run strict enforcement campaigns during June and December

- Don’t leave it to your driver—check it yourself to avoid risks

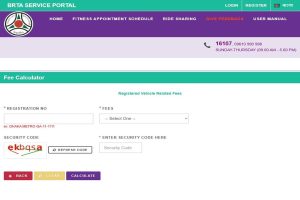

How to Check Vehicle Tax & Fitness Status Online (BRTA)

You can now verify your car’s legal status from the comfort of your home using your smartphone or PC.

Step 1: Keep Your Vehicle Registration Number Ready

Example: DHA-XX-YYYY

Step 2: Visit the BRTA Portal

🔗 https://bsp.brta.gov.bd/registeredVehicleFeesIndex?lan=en

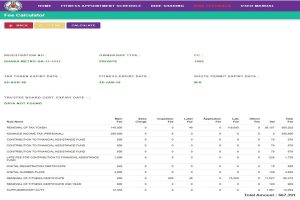

Enter your registration number and search. You’ll get details like:

- Tax payment status

- Fitness certificate expiry date

- Route permit validity

- Trustee Board certificate date

This quick check can help you avoid unnecessary risks and ensure legal compliance.

Bonus Tip: Use Prohori GPS Tracker to Stay Ahead

The Prohori GPS Tracker doesn’t just protect your car from theft—it also helps keep track of vital documents like tax, fitness, and route permit dates.

- Get automated reminders before expiry

- View your vehicle’s status anytime from the app

- Manage multiple vehicles from one dashboard

Whether you’re an individual owner or run a fleet—Prohori keeps you informed, alert, and stress-free.

Alternative Ways to Check Tax & Fitness Status

If you’re not comfortable using the BRTA website, there are other convenient options available:

BRTA Sheba Mobile App

You can also get tax and fitness information through the BRTA Sheba app, available on the Google Play Store.

- Log in to the app using your mobile number or account credentials

- Check tax status, fitness validity, registration info, and more all in one place

- A user-friendly alternative for quick and mobile access

Visit at BRTA Office

Prefer the traditional way? You can visit your nearest BRTA office with your vehicle registration number to get all necessary details. However, in most cases, online and app-based methods are faster and more hassle-free.

Prohori GPS Tracker Reminders

If you’re using the Prohori GPS Tracker, you can add your tax and fitness expiry dates directly into your profile.

- Get automatic alerts before your documents expire

- No need to manually track dates

- Especially helpful for fleet managers or owners with multiple vehicles

Conclusion

Owning a vehicle is not just a symbol of status-it’s a responsibility. Keeping your tax, fitness, and registration updated is essential for your safety, financial stability, and peace of mind. With the right tech tools like Prohori GPS Tracker, staying compliant has never been easier. It’s not just about location tracking-Prohori is your smart assistant for complete vehicle management.Your vehicle’s safety, tax updates, and legal peace-all in one place. “With Prohori, stress goes down, safety goes up.”